What role will small to medium cities play in the future of coworking?

The coworking movement has come a long way since the term was coined by programmer Brad Neuberg in the early 2000s. Over the subsequent two decades it’s gained such traction that today we can find coworking spaces almost anywhere in the world.

In fact, the number of coworking spaces worldwide is projected to exceed the 20,000 mark and reach 25,968 by 2022 (an increase of 42% from 2019) - according to research by Coworking Resources. If we look at the figures from a density perspective, we can see that the majority of these spaces are located in big cities.

Regional coworking vs coworking in big cities

The tides, however, are beginning to change.

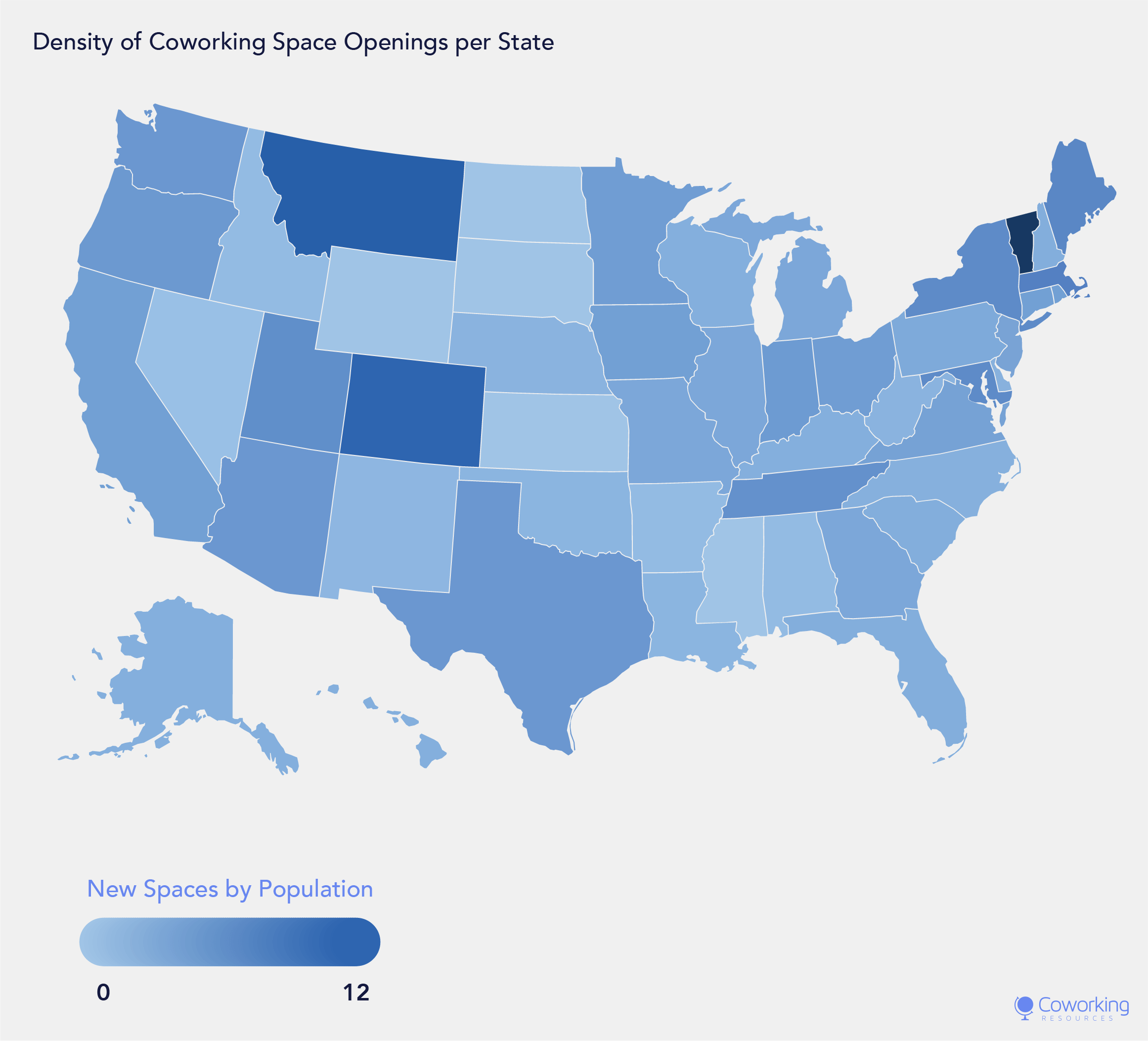

In the US, less populous states are experiencing levels of coworking growth equal to or more than those of larger ones. It’s no coincidence that the states experiencing an uptick in coworking have also witnessed small business booms and an influx of tech startups moving from states with higher taxes and operating costs.

Instant Offices’ Flexible Workspace Trends - 2019 and Beyond study highlights that demand is set to expand outside of the primary global city-based markets, driven by high living and real estate costs. According to the report, all EMEA cities have witnessed a flexspace growth of over 15% due to an increase in demand and smaller cities are pushing through.

“Forbes announced that the fastest growth markets in the US (gross metro product) in 2018 were Las Vegas, Orlando and Austin, all secondary markets, while in Europe, Manchester and Toulouse topped the UK and French markets thanks to increasing investment and a growing corporate focus.” - Instant Offices’ Flexible Workspace Trends - 2019

.png)

Results of the 2019 Global Coworking Survey by Deskmag also make for an interesting read in relation to the rise of coworking in secondary cities.

While “freelancers” made up the largest group of coworking members worldwide (at 42%) in 2019, “employers” are the biggest group in megacities.

“Looking into different continents, employees were the largest group in Asia and North America. Freelancers, on the other hand, dominated in Europe and globally in medium and small towns.” - 2019 Global Coworking Survey by Deskmag

But is this set to change in 2020?

COVID-19 could accelerate trends

The impact of COVID-19 on real estate and travel could also prompt a dramatic increase in the number of employers utilising regional coworking spaces across the globe. Anecdotal evidence from brokers and operators points to the notion that pandemic could accelerate the “back to the suburbs” trend already present prior to the outbreak.

It’s harder to adhere to social distancing in densely populated cities that rely on crowded transportation to get people from A to B. Leasing enquiries are down and there are indications that regional satellite offices are on the rise. People are (understandably) reluctant to commute if they don’t have to. What’s more, many firms - including famous brands like Twitter and Square - have realised that dispersed teams can be just as productive as centralised ones and are rolling out remote working for the foreseeable future.

Twitter CEO Jack Dorsey is allowing employees to continue working from home for as long as they see fit.

Speaking to Reuters, James Ritman, an MD at brokerage Newmark Knight Frank, says: “All this demand, all this activity that is coming out of New York, is 100% based on the virus, the fact that there is an uncertainty surrounding New York City with mass transit, with buildings and spaces that are typically pretty dense.”

Are coworking spaces profitable in small cities?

In recent years, coworking spaces have embraced the scaling economy, trying to maximise the profitability of their spaces by looking at large locations while keeping their running/management costs controlled. Considering the price per sqmt in big cities, it’s traditionally been a challenge for small operators to break even.

Real estate pricing is not always a problem in small to medium-size cities, where there’s usually plenty of vacant office space available at a competitive price in the market. The challenges presented by the pandemic are prompting businesses to think outside the box in ways that could benefit local coworking spaces financially.

Speaking with GCUC UK, Natasha Guerra from UK-based coworking operator, Runway East, said: “Short term, people are questioning whether hot-desking and the office is dead, but longer-term, when we come out of this, I think we, and local spaces in particular, will benefit.”

In terms of attracting new members, coworking operators across the spectrum are looking to introduce ventilation systems and improve the overall air quality in their spaces.

How will coworking shape the future of work in small/medium size cities?

Health aside, with big cities becoming increasingly expensive and technology enabling people to work remotely with ease, many people see small and medium cities and towns as the solution to the work/life balance conundrum.

It’s likely that, in the next decade, we’ll witness a migration of skilled professionals from big cities to medium-size ones.

Coworking spaces have the potential to act as a bridge to the local community, benefiting other local businesses and individuals as well as paying members. Together with keeping innovative, entrepreneurial talent in the community, coworking spaces like Creative Works in a residential area of East London, for example, are actively working to inspire and upskill the next generation.

The growing understanding of coworking needs, combined with our innovative approach means that we can keep this coworking SaaS up-to-date with new features and improve the user experience. If you would like to read more of our helpful tips, subscribe to our free newsletter below. Thank you for reading.

Related stories

Flexible Workspaces Management: Simplifying Corporate Success

Working from home is indeed not a new concept, at all! AT&T started to eliminate unused offices in 1991. Three years later, as part of an experiment to explore the extent to which a large organisation could revolutionise the workplace by bringing work to the employees, it had 32,000 employees working from home.

State of Remote Work 2021: What does it mean for coworking and flex workspaces?

Owl Labs recently published their 2021 State of Remote Work Report. In this article, we take a look at some of the key findings and consider what they mean for coworking and flexible workspaces.

Future of Work – What's next for the human experience in coworking and flexible workspaces?

For our final Future of Work article, we take a look at the Human Experience and how this is driving all other trends we have covered in this series. Treating members as individuals is what coworking does best, but there is never a bad time to reassert your care and devotion to your members.

The Future of Work – What’s next for the daily commute?

Is the daily commute worth it? Although people certainly miss the collaboration offered by office working, the commute is something that hasn’t been missed as much. So what does this mean moving forward, and how will the daily commute change as we move into a post-covid world?

The Future of Work – What's next for purpose-driven values in coworking and flexible workspaces

Very few people get into the coworking business just to make money quickly. It takes time to develop a coworking space into a profitable business, which is why many operators focus instead on being purpose-driven organisations. This week’s Future of Work article focuses on how to instill purpose-driven values into your space.

The Future of Work – What’s next for upskilling in coworking and flexible workspaces?

Increasingly, businesses in every sector are discovering the importance of upskilling, a great way to boost the skillset of your team. Coworking is not exempt from this as they are in the position to boost the skills of not only their staff but their members too!

The Future of Work – What’s next for diversity and inclusion in coworking and flexible workspaces?

With increasing scrutiny placed on businesses to employ proper measures to ensure a diverse and inclusive workforce, it's vital to have a proper understanding of the terms diversity and inclusion and what they mean. This week's Future of Work article focuses on this vitally important issue, and what coworking spaces can do to make sure they are doing their part for this essential movement.

The Future of Work – What's next for digital communication?

The way we all communicate has changed drastically over the past year, and as much as we all want to get back to normal, it seems likely that this kind of digital communication will be with us for some time yet. This week, we focus on how digital communication will impact the future of work for years to come.

The Future of Work – What’s next for hygiene in workspaces?

It will come as no surprise that an increased focus on office hygiene will play a massive role in the Future of Work. Here we take a look at the broader hygiene trends as well as the measures being taken to combat the spread of coronavirus.

The Future of Work – What’s next for sustainability in the workplace?

The third focus article in our Future of Work series takes a look into sustainability, and how workspaces can make changes to reduce their impact on the environment. We offer a number of different tactics that can be taken, from small changes to more wide-ranging ones.